On June 25, 2024, tear gas grenades exploded as protesters attempted to aid the injured outside the Kenyan Parliament in Nairobi. The demonstrations, which are part of a nationwide strike against the Finance Bill 2024 and tax increases, have turned increasingly violent. Despite President William Ruto withdrawing the controversial bill, many protesters are now calling for his resignation.

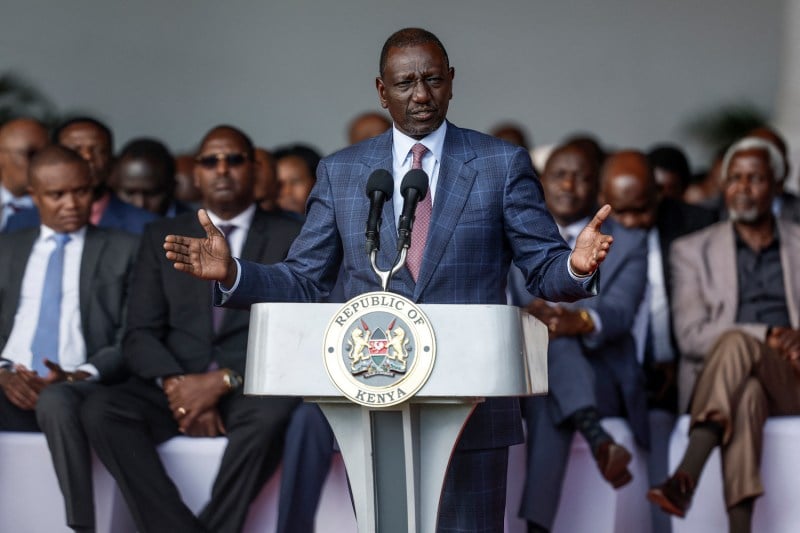

William Ruto, Kenya’s fifth president, has been in office since 2022 after narrowly winning the election with 50.5% of the vote. Allegations of election rigging led to the Supreme Court upholding the result. Ruto, who had previously served as vice president, campaigned as a reformer, promising economic improvements and job creation. However, his administration’s failure to deliver economic relief was highlighted by the 2023 finance bill, which proved unpopular.

The International Monetary Fund (IMF) reported in June 2024 that Kenya had experienced a significant decline in tax revenues and a worsening fiscal balance, necessitating increased domestic borrowing. The IMF recommended substantial fiscal adjustments for the 2024–25 fiscal year. In response, Ruto introduced a new bill on June 18, 2024, proposing nearly $2.7 billion in tax increases across various sectors.

The proposed tax increases, including new levies on basic goods like bread, vegetable oil, and sugar, along with a 2.5% annual tax on vehicles, a “green levy” on manufactured goods, and a levy on landowners, have particularly affected the middle class, according to tax law expert Sabare Oyoo. The government’s justification for the tax hikes was to support government operations while Ruto enjoyed the perks of office, including private jet travel. This rationale has been widely criticized.

Protests initially started in Nairobi and spread across Kenya, escalating into violence. Demonstrators stormed and set fire to Parliament, resulting in police intervention. On June 25, at least 22 people were killed, hundreds injured, and numerous arrests were made, with accusations of police brutality.

The Law Society of Kenya criticized the government’s dismissal of protesters’ grievances, noting that officials derided them as privileged and unproductive. In response, the association has established a toll-free number for legal assistance for those affected by the unrest.

The majority of protesters are young people, reflecting Kenya’s youthful population and high unemployment rates. Bosire Nyamori, a law lecturer at the University of Nairobi, attributes the unrest to high living costs and widespread dissatisfaction with governance, corruption, and inadequate political accountability.

Kenya’s tax structure is progressive, with rates starting at 10% and rising to 35% on higher incomes. However, Kenya’s tax-to-GDP ratio was just 15.2% in 2023, below the average for African countries. Frequent changes in tax policy complicate compliance and deter investment, exacerbating economic issues.

In the wake of the unrest, Ruto withdrew the finance bill and commended the youth for exercising their constitutional rights. He condemned the violence and promised to engage with stakeholders to address national issues. Despite this, protests continue with many calling for Ruto’s resignation under the hashtag #RutoMustGo. Roadblocks and heightened security measures are in place around Nairobi, but participation in the “One Million People March” was lower than expected, likely due to security fears.

Nyamori notes that the protests may shift focus from tax issues to broader national problems. The government has initiated a youth forum to address these concerns, though Oyoo suggests that dissatisfaction with government performance will persist. According to the Kenya Human Rights Commission, since June 18, 39 people have died in clashes, 32 have disappeared, and 627 have been arrested.